Bookkeeping

Alleviating the Burden of Financial Management in your Business

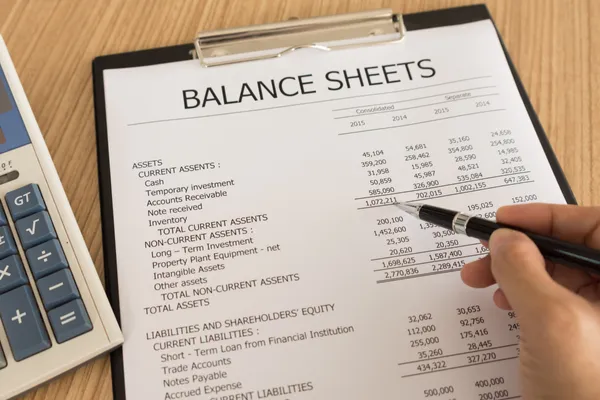

Disorganized bookkeeping can lead to missed opportunities, tax penalties, and a lack of insight into your business's financial health. Inaccurate records make it difficult to track expenses, manage cash flow, and make informed business decisions. Without proper bookkeeping, you risk non-compliance with tax regulations and facing potential audits, which can be both stressful and costly.

Get Your Financials in Order Today!

Why Choose Our Bookkeeping Services?

Stress-free compliance with tax regulations.

Accurate and timely financial records.

Transform Your Financial Management with Expert Bookkeeping

Developing a strong financial foundation and understanding increases the success of the business

Bookkeeping is essential for maintaining a strong financial foundation.

It involves meticulously recording, categorizing, and managing all your business transactions.

Proper bookkeeping ensures your financial records are accurate and organized, providing a clear view of your business's financial status.

Our expert services ensure compliance with tax regulations, streamline financial processes, and offer valuable insights for strategic decisions.

Focus on what you do best and leave the financial details to us.

Accuracy with your Financial Records

Meticulous transaction recording

Regular reconciliations

Detailed financial statements

Monthly check-ins and reports

Compliance with Tax Regulation

Timely tax filings

Increase earnings / reduce penalties

Accurate tax deductions

Up-to-date regulatory compliance

Financial Insights For Better Decisions

Custom financial reports

Comprehensive profitability report

Cash flow analysis

Budgeting and forecasting

Take the First Step Towards Stress-Free Finances

Discover Your Financial Success Score

Hear What Our Clients Say

Hear from Our Satisfied Clients

Discover how we've helped businesses just like yours achieve their financial goals. Our client success stories highlight real-world examples of how our comprehensive services have made a difference.

Rory

Owner, Frontline Property Management

"I have been working with David for the better part of two years and my business has grown tremendously. With his business knowledge and skills has help me identify numerous areas in my business that needed help."

Maria D.

"Very professional! Maria helped me with all my needs and questions. I’m very happy with her service and will trust her again in the future. Thanks so much for all you did."

Jonathon

Owner, JP Finishes

"Because David knows his numbers, he has helped my grow my painting business by over 250% in the last 3 months. He has helped my focus on the what's important and build on that. I highly recommend David to any business owner that is serious about growing their business."

Jared B.

"Very professional! Maria helped me with all my needs and questions. I’m very happy with her service and will trust her again in the future. Thanks so much for all you did."

Chart of Accounts Guide & Set Up

Master Your Finances: Chart of Accounts Made Easy

Build a Solid Financial Foundation

Gain confidence in managing your finances by understanding and setting up your Chart of Accounts. Streamline your financial reporting and decision-making processes.

Benefit from clarity and organization that empowers better financial management.

Financial Navigator Blog

A Resource With Business And Personal Financial Wisdom and Growth

7 Tips on How To Teach Kids About Finances

7 Tips on How to Teach Your Kids About Finances

Teaching kids about finances is one of the most valuable life skills you can impart. Understanding money management early can set them up for a lifetime of financial success. Here are some tips to help you introduce your children to the world of finance in a fun and engaging way:

Explain what money is and how it’s used. Use real coins and notes to make it tangible. Teach them the difference between things they need and things they want. Use everyday examples to illustrate this concept.

Take them grocery shopping and explain how to compare prices and budget. Let them help with making choices within a set budget. Give them a small allowance and help them decide how to save, spend, and share it.

Start with a piggy bank for younger kids. Encourage them to save a portion of their allowance or money they receive as gifts. For older kids, open a savings account and show them how to monitor their balance and interest earned.

Help them set small, achievable savings goals, like buying a toy. This teaches the value of delayed gratification. Discuss larger goals, such as saving for a big purchase or future education.

Create a basic budget with their allowance. Show them how to allocate money for savings, spending, and sharing. Encourage them to keep track of their spending to understand where their money goes.

Use board games like Monopoly or online financial games to teach money management in an entertaining way. Explore kid-friendly financial apps that teach money concepts through interactive activities.

Demonstrate good financial habits in your own life. Kids learn a lot by observing their parents. Discuss family budgeting and saving goals. Show them how you make financial decisions.

Teaching kids about finances doesn’t have to be daunting. By incorporating these tips into everyday activities, you can help your children build a strong foundation for financial literacy. Start early, be patient, and watch them grow into financially savvy adults.

Stay Informed and Empowered

We respect and protect your privacy. Your data is secure with us, and we promise not to spam your inbox.

Our emails are focused on delivering valuable and useful information to support you and your business.

Maximize Your Profits, Grow Your business and Reclaim Your Time

© 2025 Your FS Matrix Inc. - All Rights Reserved

Powered by SmartBiz Workspace and Designed by Biz 2 Biz Links Inc. Terms & Conditions | Privacy Policy