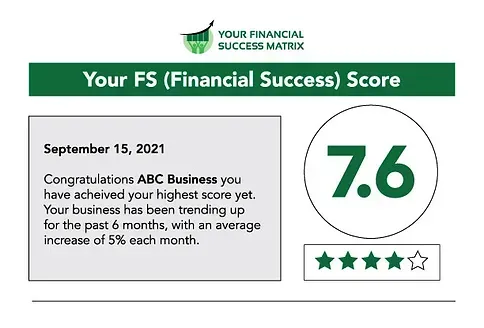

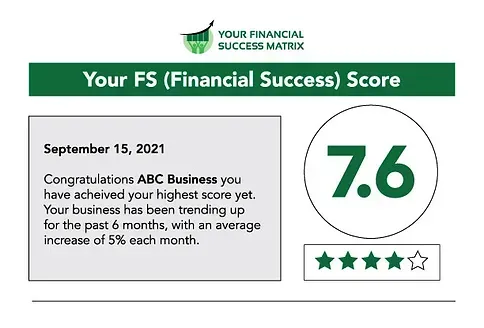

Financial Success (FS) Score

Unlock Your Business Potential with Our Financial Success Score

Discover Your Financial Health

Are you a business owner looking to understand the financial health and potential of your business? Our Financial Success Score is a comprehensive tool designed to evaluate your business's financial performance and provide actionable insights for growth. By completing our quick online survey, you will receive a personalized score that highlights your strengths and identifies areas for improvement.

Discover Key Insights to Drive Growth and Profitability

Why Find Out Your Financial Success (FS) Score?

Discover Key Insights to Drive Growth and Profitability

Comprehensive Analysis:

Gain a well-rounded view of your business's performance by evaluating key aspects such as financial management, operational efficiency, and strategic planning.

Personalized Insights:

Receive a detailed, customized report that addresses your specific business needs and provides actionable strategies to drive growth and profitability.

Benchmarking:

See how your business stacks up against industry standards and competitors, allowing you to identify where you excel and where there's room for improvement.

Actionable Recommendations:

Get practical advice and strategic recommendations tailored to your business, helping you enhance your financial health and overall success.

Informed Decision-Making

Strategic Growth

Operational Excellence

Enhanced Competitiveness

Taking the Financial Success Score survey is your first step towards

achieving financial excellence and long-term business success.

Empower yourself with the knowledge and tools needed to make strategic, informed decisions.

Ready to unlock your business's potential?

Hear What Our Clients Say

Hear from Our Satisfied Clients

Discover how we've helped businesses just like yours achieve their financial goals. Our client success stories highlight real-world examples of how our comprehensive services have made a difference.

Rory

Owner, Frontline Property Management

"I have been working with David for the better part of two years and my business has grown tremendously. With his business knowledge and skills has help me identify numerous areas in my business that needed help."

Maria D.

"Very professional! Maria helped me with all my needs and questions. I’m very happy with her service and will trust her again in the future. Thanks so much for all you did."

Jonathon

Owner, JP Finishes

"Because David knows his numbers, he has helped my grow my painting business by over 250% in the last 3 months. He has helped my focus on the what's important and build on that. I highly recommend David to any business owner that is serious about growing their business."

Jared B.

"Very professional! Maria helped me with all my needs and questions. I’m very happy with her service and will trust her again in the future. Thanks so much for all you did."

Your Financial Navigator Blog

Your Resource for Financial Wisdom and Business Growth

Explore The Financial Navigator for expert insights and practical tips on managing your business finances.

Unlock the knowledge you need to drive growth and achieve lasting success.

Running a Seasonal Business: What Every Owner Should Know

If your business has a busy season and a slower one, you know the financial highs and lows can feel intense. Whether you're preparing for peak months or navigating the quieter times, good planning makes all the difference.

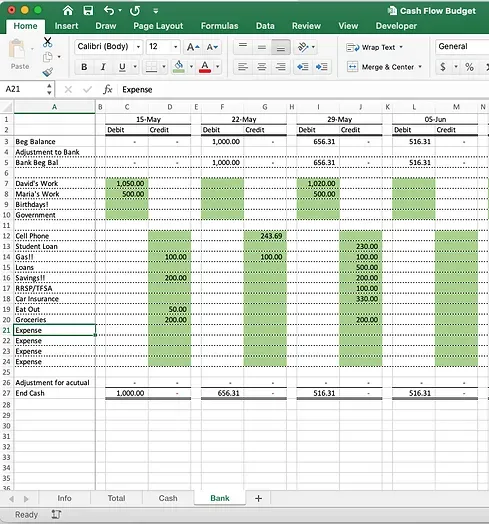

Here are some financial tips to help you manage your seasonal cash flow and set your business up for year-round stability:

Use your peak-season income to support slower months. Look at your full-year forecast, not just your high-revenue periods.

Put money into a savings account when revenue is strong. It’ll help cover overhead when things slow down, so you can avoid scrambling.

Review last year’s sales and expenses. Are there patterns? Knowing when to cut back or ramp up spending can help you stay in control.

Know how much you need to bring in each month to cover your essentials. That number matters even more for seasonal businesses.

Use the off-season to catch up on your books, review your pricing, plan content, or invest in systems that will make your busy season run smoother.

Build business credit by making timely payments and keeping credit usage low. Strong credit can open doors to better funding and terms when you need them.

Apply for a line of credit while revenue is strong. It gives you financial breathing room during slower months and keeps you from relying on high-interest options.

We help businesses from all backgrounds, shapes, and sizes. Whether you're just getting started or scaling to the next level, numbers are the language we speak and we use them to help you build clarity, strategy, and stability in your business.

If you're ready to get clear on your cash flow and plan with more confidence, reach out. We'd love to support you.

Stay Informed and Empowered

We respect and protect your privacy. Your data is secure with us, and we promise not to spam your inbox.

Our emails are focused on delivering valuable and useful information to support you and your business.

Maximize Your Profits, Grow Your business and Reclaim Your Time

© 2025 Your FS Matrix Inc. - All Rights Reserved

Powered by SmartBiz Workspace and Designed by Biz 2 Biz Links Inc. Terms & Conditions | Privacy Policy