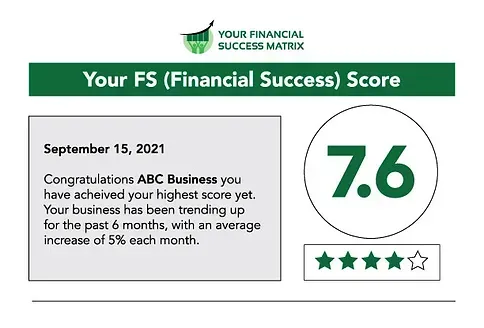

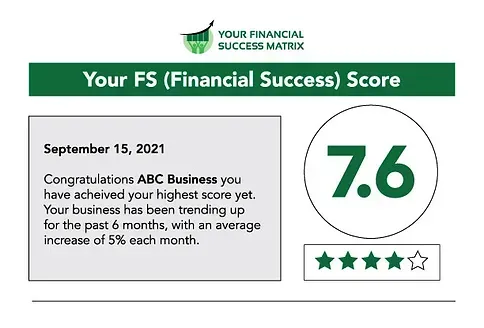

Financial Success (FS) Score

Unlock Your Business Potential with Our Financial Success Score

Discover Your Financial Health

Are you a business owner looking to understand the financial health and potential of your business? Our Financial Success Score is a comprehensive tool designed to evaluate your business's financial performance and provide actionable insights for growth. By completing our quick online survey, you will receive a personalized score that highlights your strengths and identifies areas for improvement.

Discover Key Insights to Drive Growth and Profitability

Why Find Out Your Financial Success (FS) Score?

Discover Key Insights to Drive Growth and Profitability

Comprehensive Analysis:

Gain a well-rounded view of your business's performance by evaluating key aspects such as financial management, operational efficiency, and strategic planning.

Personalized Insights:

Receive a detailed, customized report that addresses your specific business needs and provides actionable strategies to drive growth and profitability.

Benchmarking:

See how your business stacks up against industry standards and competitors, allowing you to identify where you excel and where there's room for improvement.

Actionable Recommendations:

Get practical advice and strategic recommendations tailored to your business, helping you enhance your financial health and overall success.

Informed Decision-Making

Strategic Growth

Operational Excellence

Enhanced Competitiveness

Taking the Financial Success Score survey is your first step towards

achieving financial excellence and long-term business success.

Empower yourself with the knowledge and tools needed to make strategic, informed decisions.

Ready to unlock your business's potential?

Hear What Our Clients Say

Hear from Our Satisfied Clients

Discover how we've helped businesses just like yours achieve their financial goals. Our client success stories highlight real-world examples of how our comprehensive services have made a difference.

Rory

Owner, Frontline Property Management

"I have been working with David for the better part of two years and my business has grown tremendously. With his business knowledge and skills has help me identify numerous areas in my business that needed help."

Maria D.

"Very professional! Maria helped me with all my needs and questions. I’m very happy with her service and will trust her again in the future. Thanks so much for all you did."

Jonathon

Owner, JP Finishes

"Because David knows his numbers, he has helped my grow my painting business by over 250% in the last 3 months. He has helped my focus on the what's important and build on that. I highly recommend David to any business owner that is serious about growing their business."

Jared B.

"Very professional! Maria helped me with all my needs and questions. I’m very happy with her service and will trust her again in the future. Thanks so much for all you did."

Your Financial Navigator Blog

Your Resource for Financial Wisdom and Business Growth

Explore The Financial Navigator for expert insights and practical tips on managing your business finances.

Unlock the knowledge you need to drive growth and achieve lasting success.

Smart Tips for Picking a Business Credit Card

Business credit cards can be incredibly useful, but only if you choose the right one. A business credit card should support your operations and financial goals. The right card can help you manage cash flow, earn rewards, and simplify your business spending, but not all cards offer the same benefits.

Here are a several key things to look for:

1. Look at the annual fee. Some cards offer great value, but make sure the perks actually justify the cost. If not, you might be better off with a no-fee option.

2. Check if the rewards match your business spending. If you travel often, a card with airline or hotel points could be helpful. If most of your spending is on supplies, software, or ads, look for cashback in those categories.

3. Pay attention to the interest-free period. An interest-free window can give you flexibility for short-term purchases without added costs as long as you can pay it off in time.

4. Choose a card that makes bookkeeping easier. Some cards integrate with accounting software like Xero or QuickBooks, or offer downloadable statements that simplify reconciliation and reporting.

5. Consider employee card access. If your team needs to make purchases, look for a card that allows you to issue employee cards with spending limits and tracking features.

6. Evaluate the sign-up bonus. Intro offers can be a nice bonus, but only if the minimum spend fits your usual business activity. Don’t overspend just to earn points.

7. Read the fine print. Avoid surprises by choosing a card with clear, transparent terms. Watch out for hidden fees or unclear reward structures.

We help you make confident decisions with clear numbers behind you. Schedule a call to learn more about our services.

Stay Informed and Empowered

We respect and protect your privacy. Your data is secure with us, and we promise not to spam your inbox.

Our emails are focused on delivering valuable and useful information to support you and your business.

Maximize Your Profits, Grow Your business and Reclaim Your Time

© 2025 Your FS Matrix Inc. - All Rights Reserved

Powered by SmartBiz Workspace and Designed by Biz 2 Biz Links Inc. Terms & Conditions | Privacy Policy