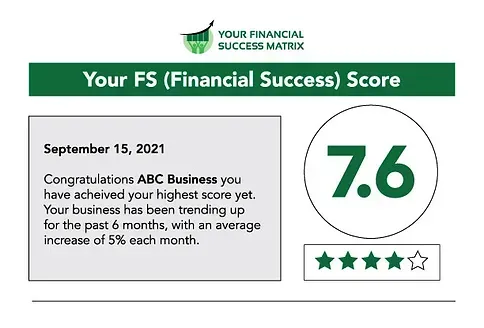

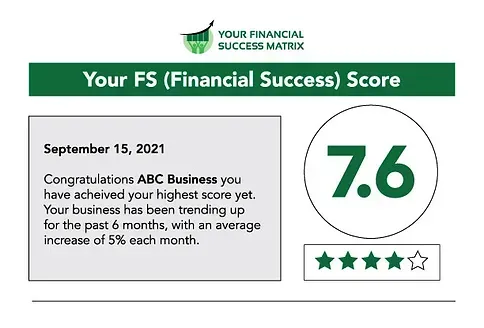

Financial Success (FS) Score

Unlock Your Business Potential with Our Financial Success Score

Discover Your Financial Health

Are you a business owner looking to understand the financial health and potential of your business? Our Financial Success Score is a comprehensive tool designed to evaluate your business's financial performance and provide actionable insights for growth. By completing our quick online survey, you will receive a personalized score that highlights your strengths and identifies areas for improvement.

Discover Key Insights to Drive Growth and Profitability

Why Find Out Your Financial Success (FS) Score?

Discover Key Insights to Drive Growth and Profitability

Comprehensive Analysis:

Gain a well-rounded view of your business's performance by evaluating key aspects such as financial management, operational efficiency, and strategic planning.

Personalized Insights:

Receive a detailed, customized report that addresses your specific business needs and provides actionable strategies to drive growth and profitability.

Benchmarking:

See how your business stacks up against industry standards and competitors, allowing you to identify where you excel and where there's room for improvement.

Actionable Recommendations:

Get practical advice and strategic recommendations tailored to your business, helping you enhance your financial health and overall success.

Informed Decision-Making

Strategic Growth

Operational Excellence

Enhanced Competitiveness

Taking the Financial Success Score survey is your first step towards

achieving financial excellence and long-term business success.

Empower yourself with the knowledge and tools needed to make strategic, informed decisions.

Ready to unlock your business's potential?

Hear What Our Clients Say

Hear from Our Satisfied Clients

Discover how we've helped businesses just like yours achieve their financial goals. Our client success stories highlight real-world examples of how our comprehensive services have made a difference.

Rory

Owner, Frontline Property Management

"I have been working with David for the better part of two years and my business has grown tremendously. With his business knowledge and skills has help me identify numerous areas in my business that needed help."

Maria D.

"Very professional! Maria helped me with all my needs and questions. I’m very happy with her service and will trust her again in the future. Thanks so much for all you did."

Jonathon

Owner, JP Finishes

"Because David knows his numbers, he has helped my grow my painting business by over 250% in the last 3 months. He has helped my focus on the what's important and build on that. I highly recommend David to any business owner that is serious about growing their business."

Jared B.

"Very professional! Maria helped me with all my needs and questions. I’m very happy with her service and will trust her again in the future. Thanks so much for all you did."

Your Financial Navigator Blog

Your Resource for Financial Wisdom and Business Growth

Explore The Financial Navigator for expert insights and practical tips on managing your business finances.

Unlock the knowledge you need to drive growth and achieve lasting success.

Get Ahead of Tax Season: Essential Preparation Tips

It’s never too early to start planning for tax season. Proactive preparation can help you save money, avoid stress, and ensure you're fully compliant when tax time rolls around. Here are some essential strategies and tools you can use to get ready for the next tax year.

1. Adjust Your Withholdings for Accuracy

When you start a new job, you fill out a TD1, Personal Tax Credits Return, which helps your employer determine how much tax to withhold from your paycheck. It’s important to update this form whenever significant changes occur in your life, such as getting married, changing jobs, or starting school. Some employers may ask you to complete a TD1 annually to ensure they have the most up-to-date information.

If you prefer more control over your tax withholdings, you can adjust how much is deducted from each paycheck. The “Additional tax to be deducted” section allows you to increase your withholding if you anticipate owing more taxes. Alternatively, you can reduce your withholding by claiming eligible tax credits for the year.

2. Make Timely Tax Payments

For business owners, those with multiple jobs, or individuals with substantial investment income, making estimated tax payments throughout the year is crucial. If you’ve owed $3,000 or more in taxes in recent years or expect to owe that amount this year, you’ll need to make installment payments to cover your tax liability. These payments are due quarterly on the 15th of March, June, September, and December.

You can submit your payments through the mail with Form INNS3 or conveniently online through your My Account on the CRA website. Staying on top of these payments helps you avoid penalties and ensures you’re in good standing with the Canada Revenue Agency (CRA).

3. Plan Ahead for Your Tax Refund

If you typically receive a tax refund, it’s wise to plan how you’ll manage it. When filing your tax return, you can opt for direct deposit, which allows your refund to be sent directly to your bank account, speeding up the process. You can also set up direct deposit through your My Account on the CRA website, ensuring that all refunds and credits are automatically deposited into your chosen account.

It’s important not to rely on receiving your refund by a specific date, especially if you’re planning a major purchase. Direct deposit refunds are faster than mailed checks, but timely filing by April 30th ensures you receive all your tax benefits on time.

Even if you don’t expect a refund, consider how you might save or invest any unexpected funds. You could contribute to a retirement account, a Tax-Free Savings Account (TFSA), or set aside funds in a savings account to bolster your financial security.

4. Organize and Preserve Your Tax Records

Proper record-keeping is essential for a smooth tax season. Keep all tax-related documents for at least six years, whether in physical or electronic form. For physical documents, maintain a dedicated folder to organize each document as you receive it. If you prefer digital storage, save your records on a secure external hard drive or an encrypted cloud drive.

Key documents to keep include:

T4, Statement of Remuneration Paid (Income tax slip)

T4A, Statement of Pension, Retirement, Annuity, and Other Income

T5, Statement of Investment Income (Bank savings account)

Notice of Assessment (NOA)

Copies of filed tax returns

Records of RRSP and TFSA contributions

Any correspondence from the CRA

5. Seek Professional Help When Needed

Tax preparation can be complex, but help is available. The CRA website offers a wealth of resources and guidance, including a dedicated Personal Income Tax section. You can also visit a Free Tax Clinic for assistance from professional volunteers. If you prefer speaking with someone, a list of contact numbers is available, or you can call 1-800-959-8281 for general tax inquiries.

Additionally, consider consulting a tax preparer, CPA, or financial advisor for personalized advice. If you have any questions or need assistance, don’t hesitate to reach out to us—we’re here to help you navigate the tax season with confidence.

By preparing now for tax season, you can minimize stress, maximize savings, and ensure you're fully equipped to handle your tax obligations. Start early and take control of your financial future today.

4o

Stay Informed and Empowered

We respect and protect your privacy. Your data is secure with us, and we promise not to spam your inbox.

Our emails are focused on delivering valuable and useful information to support you and your business.

Maximize Your Profits, Grow Your business and Reclaim Your Time

© 2025 Your FS Matrix Inc. - All Rights Reserved

Powered by SmartBiz Workspace and Designed by Biz 2 Biz Links Inc. Terms & Conditions | Privacy Policy