Taxes and Compliance

Alleviating the Burden of Financial Management in your Business

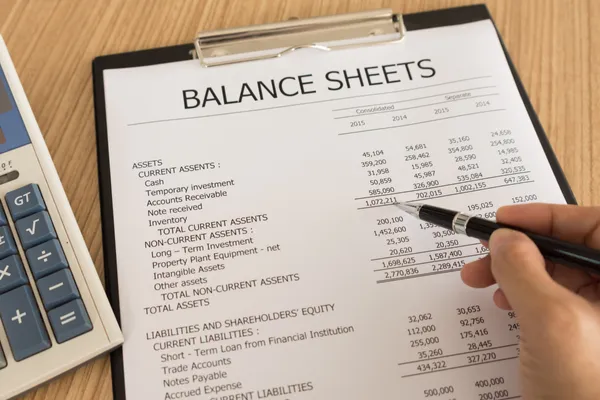

Disorganized bookkeeping can lead to missed opportunities, tax penalties, and a lack of insight into your business's financial health. Inaccurate records make it difficult to track expenses, manage cash flow, and make informed business decisions. Without proper bookkeeping, you risk non-compliance with tax regulations and facing potential audits, which can be both stressful and costly.

Turning Tax Woes into Wins

Why Choose Us As Your Tax Services Partners?

Stress-free compliance with tax regulations.

Accurate and timely financial records.

Navigating tax regulations can be complex, but our specialized tax services simplify the process and ensure compliance. We offer comprehensive tax solutions for both individuals and businesses, from personal income and rental income filings to corporate tax requirements. Our goal is to maximize deductions, minimize liabilities, and provide clarity in your financial reporting, allowing you to focus on growing your business.

Still not sure??

Turn Your Tax Woes into Wins

Tax season can be a source of significant stress and anxiety.

The fear of making mistakes, missing deductions, or facing penalties can be overwhelming. Our expert team takes the hassle out of tax season, ensuring you’re well-prepared and maximizing your financial benefits.

Maximized Savings

Identify and claim all eligible deductions.

Minimize tax liabilities and avoid penalties.

Accurately and Timely

Ensure compliance with tax regulations.

Stress-free, timely filing.

Clear & Transparent:

Clarity in your financial reporting.

Expert guidance and support.

Make Tax Season a Breeze This Year

Discover Your Financial Success Score

Hear What Our Clients Say

Hear from Our Satisfied Clients

Discover how we've helped businesses just like yours achieve their financial goals. Our client success stories highlight real-world examples of how our comprehensive services have made a difference.

Rory

Owner, Frontline Property Management

"I have been working with David for the better part of two years and my business has grown tremendously. With his business knowledge and skills has help me identify numerous areas in my business that needed help."

Maria D.

"Very professional! Maria helped me with all my needs and questions. I’m very happy with her service and will trust her again in the future. Thanks so much for all you did."

Jonathon

Owner, JP Finishes

"Because David knows his numbers, he has helped my grow my painting business by over 250% in the last 3 months. He has helped my focus on the what's important and build on that. I highly recommend David to any business owner that is serious about growing their business."

Jared B.

"Very professional! Maria helped me with all my needs and questions. I’m very happy with her service and will trust her again in the future. Thanks so much for all you did."

CRA Cheat Sheet

Navigate Tax Season Smoothly with Our CRA Cheat Sheet

Simplify Tax Compliance

Stay ahead of tax complexities with our CRA Cheat Sheet. Access quick, essential information to ensure compliance and minimize tax liabilities. Benefit from a hassle-free tax season with expert tips and insights.

Financial Navigator Blog

A Resource With Business And Personal Financial Wisdom and Growth

2nd half of 2024

How to Maximize the Next 6 Months of 2024 for Your Business Success

As we approach the midpoint of 2024, it’s crucial to evaluate your business’s progress and strategically plan for the remaining months. By implementing effective strategies now, you can ensure a strong finish to the year and set the stage for future success. Here are key actions to help you make the most of the next six months:

1. Review and Adjust Your Goals

Reflect on the goals you set at the beginning of the year. Assess which ones you’ve achieved and which need more focus. Recalibrate your objectives based on your current position, setting realistic milestones for the remainder of the year to keep your business on track.

2. Optimize Your Financial Management

Conduct a thorough analysis of your financial statements, cash flow, and budget. Identify areas to reduce costs and improve efficiency. Ensure that you’re adequately prepared for taxes and explore tax-saving opportunities. Proper financial management is key to sustaining and growing your business.

3. Enhance Your Marketing Strategy

Evaluate the performance of your existing marketing campaigns. Identify what worked well and areas that need improvement. Update your website and social media with fresh, engaging content. Plan new campaigns that will resonate with your audience and attract new customers, leveraging data-driven insights to maximize impact.

4. Invest in Your Team

Your team is your most valuable asset. Provide constructive feedback and set new goals to keep them motivated. Recognize their achievements and address areas for improvement. Consider investing in training programs to help them acquire new skills, which will benefit both your business and their professional growth.

5. Strengthen Customer Relationships

Your customers are the lifeblood of your business. Reach out for feedback and show appreciation through loyalty programs, special offers, or personalized messages. Ensure that your customer service is exemplary, addressing issues promptly and exceeding expectations to build long-term loyalty.

6. Innovate and Adapt

Stay ahead by monitoring industry trends and market shifts. Be prepared to adapt your strategies to remain competitive. Explore new markets, products, or services that could benefit your business. Embrace change and foster a culture of innovation to drive your business forward.

7. Plan for the Future

Strategic planning is essential for long-term success. Begin thinking about where you want your business to be in the next year or two. Lay the groundwork now for future growth, ensuring that your business is well-positioned to capitalize on emerging opportunities.

Conclusion: Prepare for a Strong Finish in 2024

By implementing these strategies, you can maximize the remaining months of 2024 and position your business for a successful year-end. Strategic goal-setting, financial optimization, marketing enhancement, team investment, customer relationship strengthening, innovation, and future planning are all crucial steps in ensuring your business thrives.

If you’re looking to streamline your financial management and focus on growing your business, we’re here to help. Schedule a call with us today to discover how we can support your success.

Stay Informed and Empowered

We respect and protect your privacy. Your data is secure with us, and we promise not to spam your inbox.

Our emails are focused on delivering valuable and useful information to support you and your business.

Maximize Your Profits, Grow Your business and Reclaim Your Time

© 2025 Your FS Matrix Inc. - All Rights Reserved

Powered by SmartBiz Workspace and Designed by Biz 2 Biz Links Inc. Terms & Conditions | Privacy Policy